How will the spring budget affect mortgage rates?

You might be wondering how the Spring budget affects mortgage rates and what’s going to happen to mortgage rates over the next few months, especially if you’re planning on buying a home, or are coming to the end of your current mortgage deal.

The Spring budget will see a continued but slower increase in the cost of living. For example, there will be large increases in broadband and mobile bills this April as well as price rises in the shops, so many homeowners will face higher mortgage demands, so getting the best deal will be of high priority to many as the predicted increase in the Bank of England’s Base Rate is likely to peak this year.

What does the Bank of England have to do with how the spring budget affects mortgage rates?

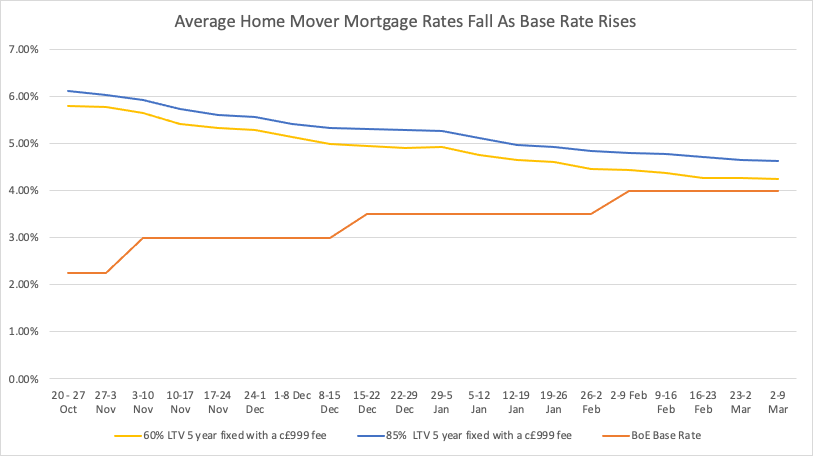

The Bank of England meets around every 6 weeks to vote on whether to change the Base Rate and by how much. During the last meeting on the 23rd of March, we saw the Base Rate increase by another 0.25% this will affect how much money people can earn on their savings as well as how much they have to pay back when borrowing money like mortgages and loans. The Base Rate interest currently stands at 4.25% and this is the highest it has been in 14 years, Which is great news for people saving money. However, this does mean an end to the low fixed rate mortgages between 1-2%.

We are currently seeing fixed-rate mortgages of around 4-5% with most of the lenders that we deal with on a daily basis, It is important to state that these figures are subject to change and not guaranteed and it is always best to talk to one of our advisers to discuss your circumstances, so we can advise you on the best deals that suit your needs.

Please use our new Mortgage Search Tool to get an idea of what’s available to you, or request a call back from one of our advisers

For More Information On Anything You See Below Please Contact Us

How will an interest rate increase affect mortgage rates?

If we look back to 2022 where we saw mortgage rates increase rapidly to around 7-8% with most lenders pulling their products from the market due to uncertainty.

We have now seen the market stabilising across the board, even with recent increases to the Base Rate the products that lenders are offering remaining stable and more lenders extend the ability to lock in a new deal up to 6 months in advance of your current deal ending.

There are also other factors that affect the market at the moment, for example, the impact of the events around the Silicon Valley Bank in the USA. So we will have to wait to see what the Bank of England does later this month.

Should I get a Fixed Rate or a Tracker/Variable rate mortgage?

If you are on or looking to secure a new fixed-rate mortgage then it’s good news as the rate will remain the same until the end of the deal, no matter what the Base Rate changes to. But if your current fixed-rate deal is due to end in the next 6 months then give us a call so we can lock in a new deal before your current one ends.

Around 15% of current Mortgages are Tracker or Variable rates, you will see your monthly payment change fairly instantly, your mortgage rates are set against the Bank’s interest rate, plus a percentage set by your lender, If you have questions then please contact your lender or speak to one of the team to get the best advice possible for your circumstances.

When will the interest rates drop?

Early predictions are they are still on the increase, looking to peak around 4.3% to then start coming down later in the year.

“The bank saw interest rates at 3.8% in early 2023, rising to as high as 4.3% by the first quarter of 2024. In 2025, the UK central bank predicted interest rates would fall back to 3.6%, declining further to 3.3% in 2026” Capital.com

The Bank of England meeting after this month will be on the 11th of May.

Request a

Call Back