- October 17, 2018

- Posted by: Graham Tester

- Category: PFG Mortgages

Help to Buy is even available to most existing home owners; as long as the current home is sold on or before buying your new home.

Interest rates may have increased recently but it’s still great value to buy a new home right now, thanks to the excellent Help to Buy scheme and some unique rates available to the scheme. The top 5 best buy table on this page clearly shows some of the great rates on offer for those buying a newly built home.

The Help to Buy scheme was created to help potential buyers purchase their own home with a limited deposit. Although the scheme existed for pre-owned properties, the scheme is now only available for new homes.

It is a common misconception that the Help to Buy equity loan is available to first time buyers only. In fact, home movers are also able to take advantage of this scheme even if they already have a reasonable deposit available. The only conditions being (1) you may not sublet the home, (2) part exchange your old home and (3) you must not own any other properties.

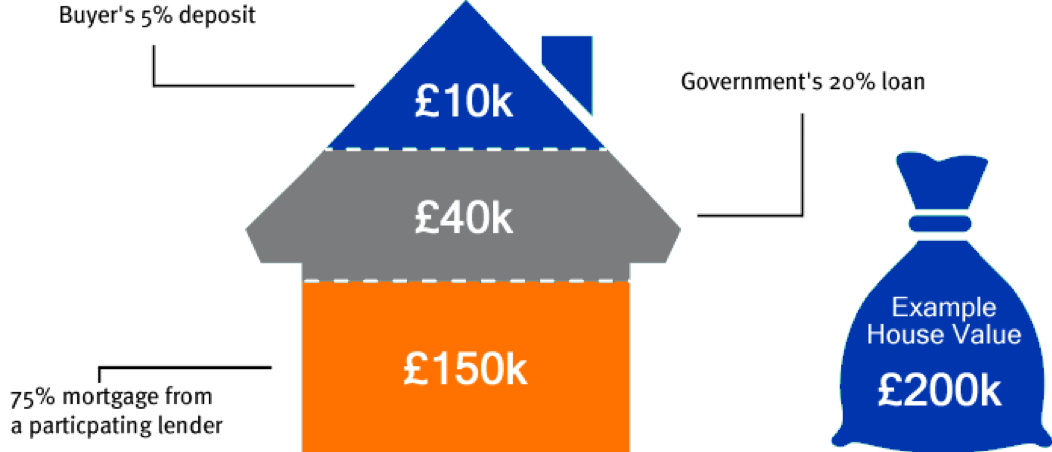

With the Help to Buy equity Loan, the Government lends you up to 20% of the cost of your newly built home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest.

Not all new homes are eligible for the help to Buy equity loan as the developer has to be registered with the scheme. Larger builders such as Kier Homes are registered for example. For smaller developers you can either check direct with them or ask for a list of local developers from Bidwells Property Consultants based in Norwich.

In addition, not all mortgage lenders are registered for Help to Buy, so you will need to shop around and seek advice from a mortgage adviser. You will also need to apply for the equity loan by completing an application form. We recommend using a mortgage broker who is familiar with the process such as Premier Financial Group.

How does it work?

The Help to Buy equity loan is interest free for the first five years, after which you will be charged a monthly fee calculated at 1.75% of the equity loan. The fee rate slowly increases year on year in line with the Retail Price Index. These Interest Only repayments will sit alongside your mortgage repayments.

Borrowers can choose to repay the equity loan at any time, without penalty but you are restricted to paying back either half or the whole amount. If you choose not to repay the equity loan while you are still living in the property, you can repay the loan when you come to sell it. The government will reclaim its percentage stake in your home at its current value this is whether the value of your property has increased or decreased.

If the home in the example above sold for £210,000, you would get £168,000 (80%, from your mortgage and the cash deposit) and you would pay back £42,000 on the loan (20%). You would need to pay off your mortgage with your share of the money.

As your mortgage will typically be 75% loan to value, mortgage lenders offer some very competitive rates and incentives. There are bespoke products designed for the help to buy scheme although not all mortgage lenders currently participate in the scheme.

Best Buy Examples; based on a property worth £200,000 with a mortgage of £150,000 over 35 years, a personal deposit of £10,000 (5%) and the Help to Buy equity loan of £40,000 (20%)

1.76% 2 year fixed rate £999 fee (which can be added to the loan) includes £1000 cash back paid on completion. £478.62 per month (APR 3.58%).

2.69% 5 year fixed rate no fee, includes a free valuation and £250 cash back. £551.64 per month (APR 3.98%).

1.39% 2 Year Fixed rate £999 fee (which can be added to the loan) includes £250 cash back paid at completion £451.24 (APR 4.16%).

For the Equity Loan part of this example, the monthly repayment to the Government after five years would be £58.33.