Welcome to the PFG Mortgages Knowledge Bank

Please select the option below that applies

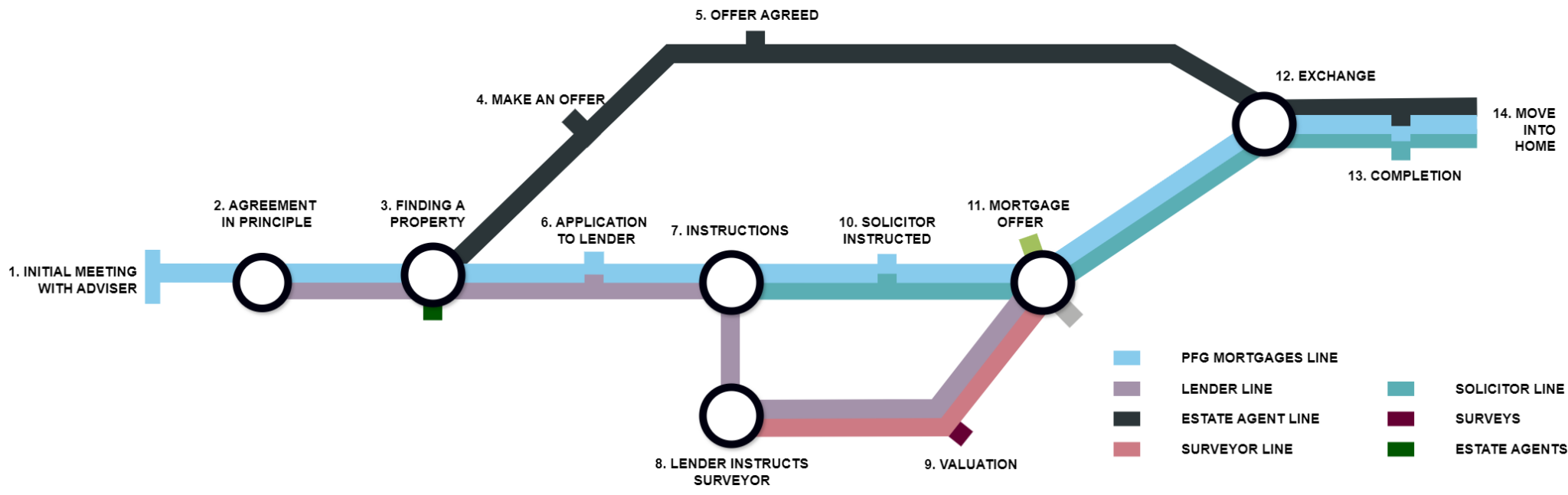

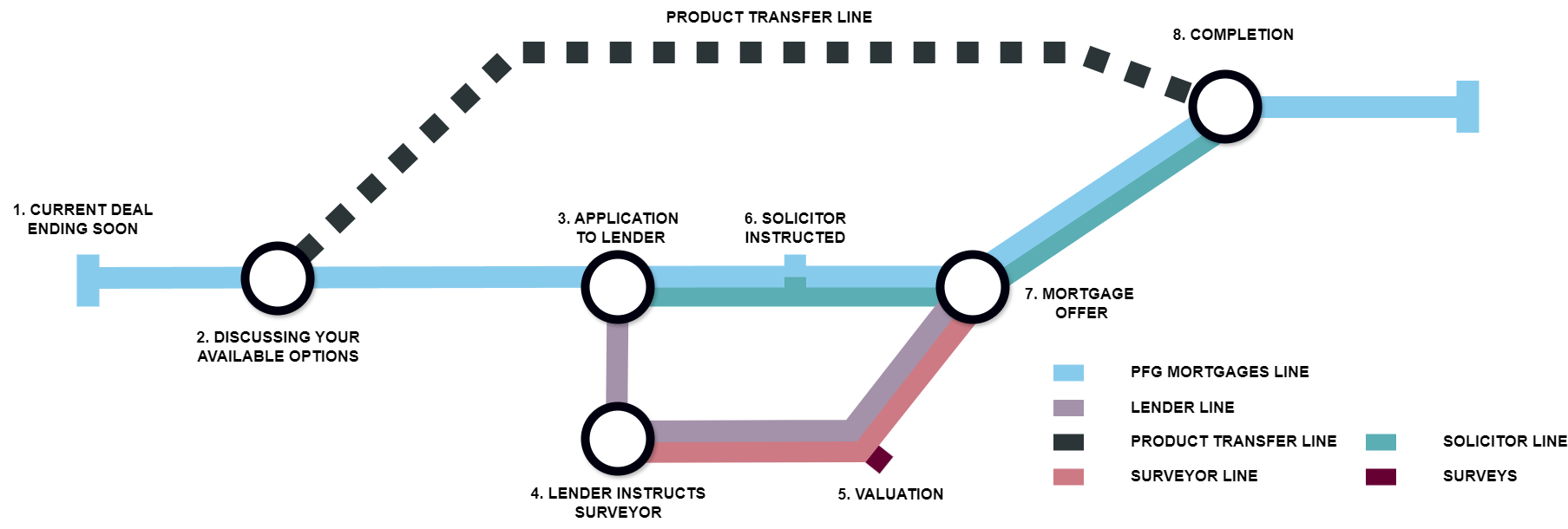

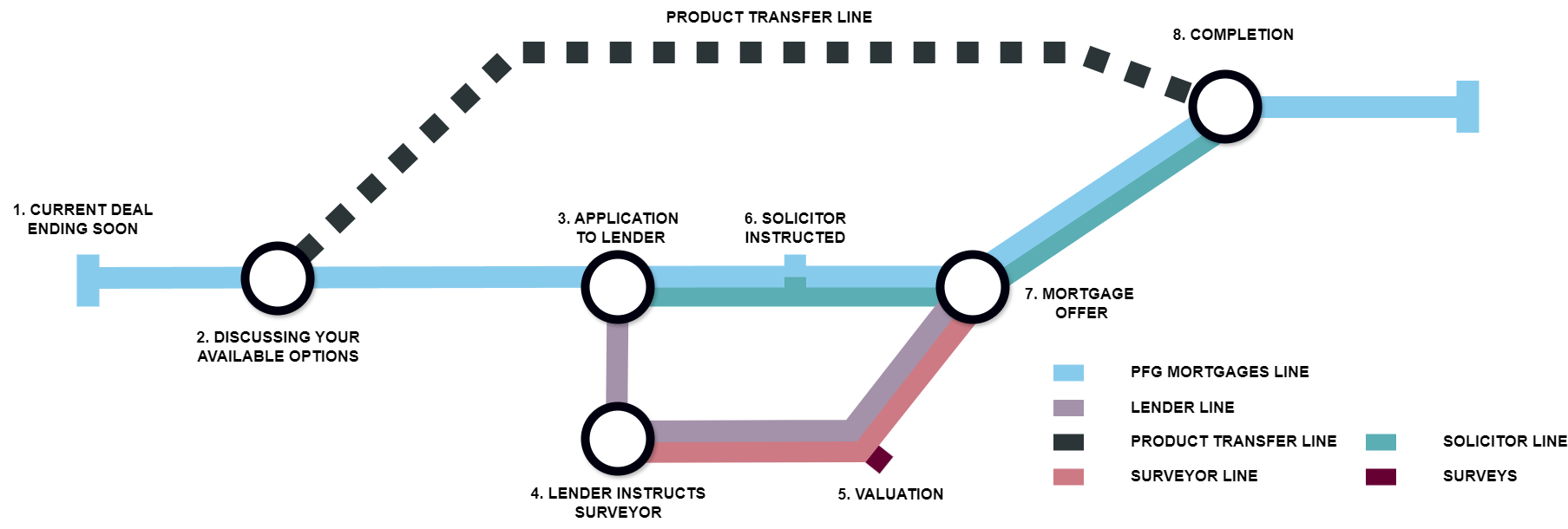

Your Mortgage Journey Planner

Feeling lost in the mortgage maze? Don’t worry, you’re not alone! Understanding the mortgage application process can be overwhelming, whether it’s your first home or your fifth. That’s why we created a simple guide, just like a London Tube map, to navigate you through each step. From finding your dream property to finally collecting the keys, our guide explains everything in clear, easy-to-understand language.

Don’t worry, there might be a few additional steps depending on your specific situation. But fear not! Your dedicated PFG Mortgage Advisor and Admin Team will be there every step of the way. They’ll explain everything clearly and guide you through the entire process, ensuring a smooth mortgage journey.

Some of the other terms that you will encounter along your mortgage journey are:

Under offer:

Once you have had your offer accepted, you are then ‘Under Offer’. At this point you will need the submit your mortgage application, with all the relevant information and documents requested by the broker The mortgage is underwritten then the valuation is instructed.

Memorandum Of Sale:

This document outlines the sale price, property address, any special conditions and the contact details for the seller, purchaser and both Solicitors. This is sent out to all parties from the selling agent.

Valuation / Survey

Before a mortgage lender will release any funds on a property they instruct a RICS Chartered Surveyor to carry out a mortgage valuation to ensure that they would be able to recover the cost of the property should your purchaser default on their mortgage.

Conveyancing

Your solicitor will send your Title Deeds along with all other paperwork relating to the sale to your buyer’s Solicitor who will obtain the appropriate searches and raise any enquiries that they have relating to the content. Once all searches have been received and all enquiries satisfied they will prepare contracts for each party.

Exchange

Once all contracts in the chain have been signed and deposits received the Solicitors will ‘Exchange Contracts’, this is legal commitment from all parties and now sets in stone the agreed completion date.

Sale Complete

The sale will officially ‘Complete’ on the date agreed in the contracts, when all funds have landed with the seller’s Solicitor.

Frequently Asked Questions

How much can I borrow?

Lenders use an “affordability check” to determine this. They primarily look at your annual income, but also consider your spending habits, existing debt, and financial commitments. A common rule of thumb is that you can borrow around 4 to 4.5 times your annual salary, but this can vary

What documents do I need?

You will need to provide various documents to prove your identity, income, and financial stability. These typically include:

- Proof of Identity: Passport or driving licence.

- Proof of Address: Recent utility bills or bank statements.

- Proof of Income: Recent payslips and P60 forms if you’re employed, or two to three years of certified accounts if you’re self-employed.

- Bank Statements: Usually three to six months of statements to show your spending habits.

What types of mortgages are available?

Common options include fixed-rate, variable-rate

What is a Decision in Principle (DIP)?

An DIP also known as an Agreement in Principle, or Mortgage in Principle (MIP), is a document from a lender that provides an estimate of how much they might be willing to lend you. It’s based on a basic assessment of your finances and a soft credit check. Having an DIP shows estate agents that you are a serious buyer.

What are the other costs involved in buying a home?

Beyond the deposit and the mortgage itself, you should budget for:

- Stamp Duty Land Tax (SDLT): A government tax on property purchases.

- Legal Fees: To pay for a solicitor or conveyancer who handles all the legal work.

- Survey Fees: To pay for a surveyor to check the property for any issues.

- Lender Fees: Including a mortgage arrangement fee, which can often be added to the mortgage itself.

- Removal Costs: For moving your belongings.

What is Stamp Duty Land Tax (SDLT)?

SDLT is a progressive tax that you pay when you buy a property or land over a certain price in England and Northern Ireland. The amount you pay depends on the purchase price and whether you are a first-time buyer. In Scotland, it is known as Land and Buildings Transaction Tax (LBTT), and in Wales, it is Land Transaction Tax (LTT).

How long does a mortgage application take?

Typically 2–6 weeks from application to offer, depending on circumstances, lender, and property checks.

Can I repay my mortgage early?

Yes, but early repayment charges (ERCs) may apply, depending on your mortgage terms.

What happens if I miss a mortgage payment?

Missing a payment can impact your credit score and may lead to legal action if unresolved. Always contact your lender as early as possible if you’re struggling.

What is the difference between a fixed-rate and a variable-rate mortgage?

- A fixed-rate mortgage means your interest rate is locked in for a set period (e.g., two, five, or ten years). Your monthly repayments will remain the same during this time, regardless of changes to the Bank of England’s base rate. This offers stability and predictability.

- A variable-rate mortgage means your interest rate can go up or down. Your monthly repayments will change accordingly. A common type of variable mortgage is a tracker mortgage, which directly tracks the Bank of England’s base rate plus a set percentage.

What is the difference between a repayment mortgage and an interest-only mortgage?

- repayment mortgage is the most common type. Each monthly payment covers both the interest on the loan and a portion of the capital (the original amount borrowed). As long as you keep up with your payments, the mortgage will be fully paid off by the end of the term.

- An interest-only mortgage means your monthly payments only cover the interest on the loan. The original capital amount is not reduced. At the end of the mortgage term, you will need a plan to pay back the full amount, such as selling the property or using savings or other investments.

Are there any government schemes to help first-time buyers?

Yes, options include:

- Lifetime ISA (LISA)

- Shared Ownership

- First Homes Scheme

- Help to Buy (now closed to new applications, but some still in repayment phase)

Useful Documents

Useful Links (open in new windows)

Your Remortgage Journey Planner

Many homeowners face this situation, and you have options! Two popular choices are remortgaging and product transfer. Both let you switch to a new mortgage deal, but they work in different ways and offer different benefits. Let’s explore which might be the right fit for you.

Remortgaging is a breeze!

Your journey starts with a quick chat with your dedicated mortgage adviser. They’ll review your existing mortgage details and discuss your current financial situation. Remember to mention any changes in your circumstances since your initial application, as these can affect your remortgage options.

Once everything’s clear, your adviser will recommend the best remortgage option tailored to your needs.

The good news? The documentation required is the same as your first mortgage application. Gather your payslips, bank statements, and updated ID to proceed smoothly.

The Simplicity Of A Product Transfer

A product transfer, on the other hand, involves switching to a new mortgage deal with your existing lender. This process is generally simpler and faster than remortgaging, as there’s no need for a new property valuation or legal work. It’s also often a cost-effective option, as you may avoid paying certain fees associated with remortgaging.

Frequently Asked Questions

What types of mortgages are available?

Common options include fixed-rate, adjustable-rate, and FHA loans (government-backed for first-time buyers).

How do I know if I have a good remortgage rate?

Don’t get caught out hunting for the “best rate”. The best rate is not necessarily the best deal as it might come with extra fees, hidden charges or even higher ERCs (Early Repayment Charges). We will tell you the best mortgage deal for you and your circumstances and not just the best mortgage rate.

What documents do I need?

Typically, you’ll need pay slips, bank statements and a photo ID.

How long does it take to organise a remortgage?

It generally takes around eight to twelve weeks but often quicker depending on circumstances

What happens if I can't make my mortgage payments?

It’s crucial to contact your lender immediately to discuss options to avoid defaults on your payments

Useful Documents & Links

Premier Financial Group was established in March 1990. We are fully qualified Financial Services Advisers directly authorised by the FCA (Financial Conduct Authority). Click here to meet the team

Premier Financial Group cares for the financial needs of our clients both individual and corporate by applying the highest level of skill and expertise to the advice and service we give regardless of the client’s wealth. Most new clients are referred to us by personal recommendation from existing clients or professional firms so doing a good job is top of our priorities.

What do we do best?

We are committed to helping you from our first point of contact through to completion of a product as well as offering our after care service ensuring you can continue on the right track for life. The Financial Conduct Authority directly authorises us, our qualified advisers can choose products from the whole market. More importantly, each of our advisers specialise in a certain area instead of a ‘jack of all trades’ approach you may see elsewhere.

PFG Mortgages are your Mortgage Specialists

We are 100% independent and can advise on products

across the whole mortgage market

Our 5* rated team is always on hand to help

With you from application to completion and beyond

More than just Mortgages we offer advice on Insurance, Wills, & Investments

Please get in touch today for a no-obligation conversation about how we can help

find you the best mortgage for your needs.

Why Choose

Checkout our Reviews

Your Mortgage Journey Planner

Feeling lost in the mortgage maze? Don’t worry, you’re not alone! Understanding the mortgage application process can be overwhelming, whether it’s your first home or your fifth. That’s why we created a simple guide, just like a London Tube map, to navigate you through each step. From finding your dream property to finally collecting the keys, our guide explains everything in clear, easy-to-understand language.

Don’t worry, there might be a few additional steps depending on your specific situation. But fear not! Your dedicated PFG Mortgage Advisor and Admin Team will be there every step of the way. They’ll explain everything clearly and guide you through the entire process, ensuring a smooth mortgage journey.

Some of the other terms that you will encounter along your mortgage journey are:

Under offer:

Once you have had your offer accepted, you are then ‘Under Offer’. At this point you will need the submit your mortgage application, with all the relevant information and documents requested by the broker The mortgage is underwritten then the valuation is instructed.

Memorandum Of Sale:

This document outlines the sale price, property address, any special conditions and the contact details for the seller, purchaser and both Solicitors. This is sent out to all parties from the selling agent.

Valuation / Survey

Before a mortgage lender will release any funds on a property they instruct a RICS Chartered Surveyor to carry out a mortgage valuation to ensure that they would be able to recover the cost of the property should your purchaser default on their mortgage.

Conveyancing

Your solicitor will send your Title Deeds along with all other paperwork relating to the sale to your buyer’s Solicitor who will obtain the appropriate searches and raise any enquiries that they have relating to the content. Once all searches have been received and all enquiries satisfied they will prepare contracts for each party.

Exchange

Once all contracts in the chain have been signed and deposits received the Solicitors will ‘Exchange Contracts’, this is legal commitment from all parties and now sets in stone the agreed completion date.

Sale Complete

The sale will officially ‘Complete’ on the date agreed in the contracts, when all funds have landed with the seller’s Solicitor.

Frequently Asked Questions

How much can I borrow?

Lenders use an “affordability check” to determine this. They primarily look at your annual income, but also consider your spending habits, existing debt, and financial commitments. A common rule of thumb is that you can borrow around 4 to 4.5 times your annual salary, but this can vary

What documents do I need?

You will need to provide various documents to prove your identity, income, and financial stability. These typically include:

- Proof of Identity: Passport or driving licence.

- Proof of Address: Recent utility bills or bank statements.

- Proof of Income: Recent payslips and P60 forms if you’re employed, or two to three years of certified accounts if you’re self-employed.

- Bank Statements: Usually three to six months of statements to show your spending habits.

What types of mortgages are available?

Common options include fixed-rate, variable-rate

What is a Decision in Principle (DIP)?

An DIP also known as an Agreement in Principle, or Mortgage in Principle (MIP), is a document from a lender that provides an estimate of how much they might be willing to lend you. It’s based on a basic assessment of your finances and a soft credit check. Having an DIP shows estate agents that you are a serious buyer.

What are the other costs involved in buying a home?

Beyond the deposit and the mortgage itself, you should budget for:

- Stamp Duty Land Tax (SDLT): A government tax on property purchases.

- Legal Fees: To pay for a solicitor or conveyancer who handles all the legal work.

- Survey Fees: To pay for a surveyor to check the property for any issues.

- Lender Fees: Including a mortgage arrangement fee, which can often be added to the mortgage itself.

- Removal Costs: For moving your belongings.

What is Stamp Duty Land Tax (SDLT)?

SDLT is a progressive tax that you pay when you buy a property or land over a certain price in England and Northern Ireland. The amount you pay depends on the purchase price and whether you are a first-time buyer. In Scotland, it is known as Land and Buildings Transaction Tax (LBTT), and in Wales, it is Land Transaction Tax (LTT).

How long does a mortgage application take?

Typically 2–6 weeks from application to offer, depending on circumstances, lender, and property checks.

Can I repay my mortgage early?

Yes, but early repayment charges (ERCs) may apply, depending on your mortgage terms.

What happens if I miss a mortgage payment?

Missing a payment can impact your credit score and may lead to legal action if unresolved. Always contact your lender as early as possible if you’re struggling.

What is the difference between a fixed-rate and a variable-rate mortgage?

- A fixed-rate mortgage means your interest rate is locked in for a set period (e.g., two, five, or ten years). Your monthly repayments will remain the same during this time, regardless of changes to the Bank of England’s base rate. This offers stability and predictability.

- A variable-rate mortgage means your interest rate can go up or down. Your monthly repayments will change accordingly. A common type of variable mortgage is a tracker mortgage, which directly tracks the Bank of England’s base rate plus a set percentage.

What is the difference between a repayment mortgage and an interest-only mortgage?

- repayment mortgage is the most common type. Each monthly payment covers both the interest on the loan and a portion of the capital (the original amount borrowed). As long as you keep up with your payments, the mortgage will be fully paid off by the end of the term.

- An interest-only mortgage means your monthly payments only cover the interest on the loan. The original capital amount is not reduced. At the end of the mortgage term, you will need a plan to pay back the full amount, such as selling the property or using savings or other investments.

Are there any government schemes to help first-time buyers?

Yes, options include:

- Lifetime ISA (LISA)

- Shared Ownership

- First Homes Scheme

- Help to Buy (now closed to new applications, but some still in repayment phase)

Useful Documents

Useful Links (open in new windows)

Your Remortgage Journey Planner

Many homeowners face this situation, and you have options! Two popular choices are remortgaging and product transfer. Both let you switch to a new mortgage deal, but they work in different ways and offer different benefits. Let’s explore which might be the right fit for you.

Remortgaging is a breeze!

Your journey starts with a quick chat with your dedicated mortgage adviser. They’ll review your existing mortgage details and discuss your current financial situation. Remember to mention any changes in your circumstances since your initial application, as these can affect your remortgage options.

Once everything’s clear, your adviser will recommend the best remortgage option tailored to your needs.

The good news? The documentation required is the same as your first mortgage application. Gather your payslips, bank statements, and updated ID to proceed smoothly.

The Simplicity Of A Product Transfer

A product transfer, on the other hand, involves switching to a new mortgage deal with your existing lender. This process is generally simpler and faster than remortgaging, as there’s no need for a new property valuation or legal work. It’s also often a cost-effective option, as you may avoid paying certain fees associated with remortgaging.

Frequently Asked Questions

What types of mortgages are available?

Common options include fixed-rate, adjustable-rate, and FHA loans (government-backed for first-time buyers).

How do I know if I have a good remortgage rate?

Don’t get caught out hunting for the “best rate”. The best rate is not necessarily the best deal as it might come with extra fees, hidden charges or even higher ERCs (Early Repayment Charges). We will tell you the best mortgage deal for you and your circumstances and not just the best mortgage rate.

What documents do I need?

Typically, you’ll need pay slips, bank statements and a photo ID.

How long does it take to organise a remortgage?

It generally takes around eight to twelve weeks but often quicker depending on circumstances

What happens if I can't make my mortgage payments?

It’s crucial to contact your lender immediately to discuss options to avoid defaults on your payments

Useful Documents & Links

Premier Financial Group was established in March 1990. We are fully qualified Financial Services Advisers directly authorised by the FCA (Financial Conduct Authority). Click here to meet the team

Premier Financial Group cares for the financial needs of our clients both individual and corporate by applying the highest level of skill and expertise to the advice and service we give regardless of the client’s wealth. Most new clients are referred to us by personal recommendation from existing clients or professional firms so doing a good job is top of our priorities.

What do we do best?

We are committed to helping you from our first point of contact through to completion of a product as well as offering our after care service ensuring you can continue on the right track for life. The Financial Conduct Authority directly authorises us, our qualified advisers can choose products from the whole market. More importantly, each of our advisers specialise in a certain area instead of a ‘jack of all trades’ approach you may see elsewhere.

PFG Mortgages are your Mortgage Specialists

We are 100% independent and can advise on products

across the whole mortgage market

Our 5* rated team is always on hand to help

With you from application to completion and beyond

More than just Mortgages we offer advice on Insurance, Wills, & Investments

Please get in touch today for a no-obligation conversation about how we can help

find you the best mortgage for your needs.

Why Choose

Checkout our Reviews